Moreover, understanding the limitations and context-specific nuances of the PI ensures that it is employed effectively, avoiding the pitfalls of misinterpretation. The Profitability Index (PI) or profit investment ratio (PIR) is a widely used measure for evaluating viability and profitability of an investment project. It is calculated by dividing the present value of future cash flows by the initial amount invested. If the profitability index is greater than or equal to 1, it is termed a good and acceptable investment.

- The outcome is our Profitability Index, conveniently calculated through the power and precision of Excel.

- Although not a perfect approach, profitability index goes a long way toward handling of capital rationing, if used with caution.

- On the other hand, Tim’s investment has a PI ratio of 0.4, which means that it is not profitable.

- It embodies the discipline of rigorous financial planning and sensitivity analysis, pushing us to think in probabilities rather than possibilities.

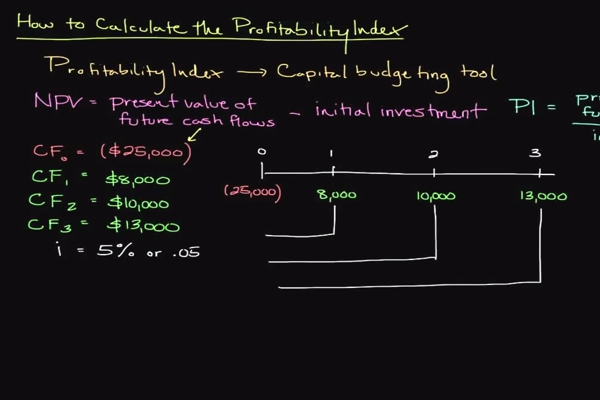

Calculation Formula

It works as a way for you to appraise a project to make a more informed decision. To find more attractive investments, look for a profitability index that is the highest. This shows that the project will generate value for your business and it can be a good investment. It is easy to calculate and is an excellent statistical measure that enables you to look through the returns of a proposed project beforehand. A profitability index greater than 1.0 is often considered a good investment, as the expected return is higher than the initial investment. Amidst various analytical tools, the Profitability Index (PI) emerges as a key player.

Interpreting the Ingredients of the Profit Index Formula

By considering the time value of money, this index enables investors to assess the attractiveness and viability of an investment opportunity. The Profitability Index Calculator streamlines this process by swiftly computing the index value, providing users with a clear and concise indicator of a project’s potential returns. The denominator is the initial investment, the upfront cost needed to undertake the project.

Examples of PI Calculations

However, the numbers needed to be able to perform that division operation might be a little bit of science to calculate. Let me show you an example of performing this calculation from start to what are the branches of accounting how they work end. We will use the NPV method as well to illustrate the same so that we can understand whether we have come to the right conclusion or not, and we will also get to know how to calculate NPV.

Real Function Calculators

In practice, let’s say I’m comparing a 3-year project with a 5-year one. The PI enables me to distill the varied cash flows into a common metric that harmonizes the time value of money, regardless of the project’s length. By examining the PI, we quickly identify which project offers a better return per dollar invested over its lifespan. This is invaluable for long-term strategic planning, where misallocation can mean loss of capital and opportunity. The numerator, the present value of future cash flows, is the sum we expect to receive over the project’s lifespan, discounted back to present value using our required rate of return.

The Profitability Index, often referred to as PI, is a financial metric that measures the potential profitability of an investment project. As someone immersed in the field of business and finance, I see PI as a ratio that compares the present value of future cash flows generated by a project to the initial investment cost. The profitability index measures the present value of future expected cash flows and the initial amount invested in a project.

Running a profitable business demands a lot of investments and assessing them for profitability is essential. The profitability index (PI), also known as profit investment ratio (PIR) is a method to describe the relationship between cost and benefits of a project. Understanding the pitfalls and limitations of the Profitability Index is just as important as harnessing its strategic benefits.

Firms follow the profitability index rule to obtain ratios that depict returns with respect to each investment dollars. Hence, it enables companies to choose projects that are best value for money. Because profitability index calculations cannot be negative, they must be converted to positive figures. Calculations greater than 1.0 indicate the future anticipated discounted cash inflows are greater than the anticipated discounted cash outflows.