The balance sheet, which outlines a company’s financial position at a specific point in time, is directly affected by the normal balances of asset, liability, and equity accounts. The proper classification and balance of these accounts ensure that the balance sheet accurately reflects the company’s assets and the claims against those assets. Similarly, the income statement, which shows the company’s financial performance over a period, depends on the correct debit and credit balances of revenue and expense accounts. The precision of these balances is crucial for calculating net income, which is a key indicator of the company’s profitability. The concept of a normal balance for each account type is integral to the coherence of financial records.

- Interest Revenues account includes interest earned whether or not the interest was received or billed.

- Forecasting, on the other hand, uses normal balances to estimate the financial outcomes of various scenarios.

- Normal balances are vital for accuracy in financial records, as they ensure each account reflects the true business activity, enabling reliable financial analysis and decision-making.

- It was started by Luca Pacioli, a Renaissance mathematician, over 500 years ago.

What are Closing Entries in Accounting? Accounting Student Guide

At the heart of this precision lies an understanding of normal account balances—a concept critical to maintaining the integrity of a company’s books. If the rented space was used to manufacture goods, the rent would be part of the cost of the products produced. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance.

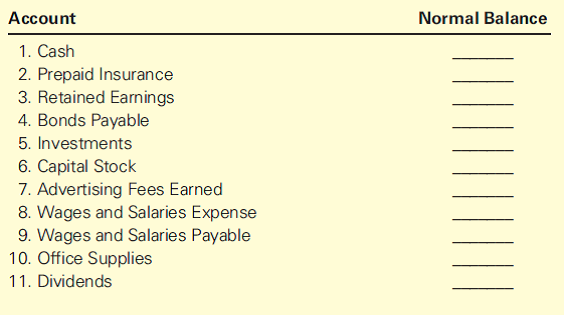

What Constitutes a Normal Balance for Different Accounts

Equity accounts typically have a credit balance, as they represent the residual interest in the assets of the company after deducting liabilities. Increases in equity, such as from additional owner investments or profits, are credited, while decreases, such as withdrawals or losses, are debited. The maintenance of these accounts is vital for providing stakeholders with information about the value of their investment in the company.

Time Value of Money

On the other hand, a business that has not reached profitability will debit a cumulative earnings/loss equity account with its losses, resulting in a negative balance. It should be noted that if an account is normally a debit balance it is increased by a debit entry, and if an account is normally a credit balance it is increased by a credit entry. So for example a debit entry to an asset account will increase the asset balance, and a credit entry to a liability account will increase the liability.

Thus, if you want to increase Accounts Payable, you credit it. Costs that are matched with revenues normal balance accounting definition on the income statement. For example, Cost of Goods Sold is an expense caused by Sales.

A current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The amount reported on the balance sheet is the amount that has not yet been used or expired as of the balance sheet date. This account is a non-operating or “other” expense for the cost of borrowed money or other credit. Salaries Expense will usually be an operating expense (as opposed to a nonoperating expense).

For instance, an increase in inventory should correspond with a decrease in cash or an increase in accounts payable, depending on whether the purchase was made in cash or on credit. Accountants look for patterns and relationships between accounts to confirm that the recorded transactions make logical sense within the context of the business’s operations. A careful look at each transaction helps decide what to record in the ledger. The increase in inventory, an asset, is a debit because that’s its normal balance for inventory.

There might be transactions that require one debit entry and two credit entries, which must add up to the same amount as that one debit entry. Normal balances ensure financial records are accurate and reliable. They show bookkeepers and accountants where to record transactions. Keeping transactions consistent is crucial for trustworthy financial reporting and analysis. This classification is based on the account’s role in the financial statements and ensures that financial transactions are recorded correctly.

Forecasting, on the other hand, uses normal balances to estimate the financial outcomes of various scenarios. By applying expected transactions to the normal balances of accounts, financial professionals can simulate the effects of business decisions on the company’s financial trajectory. This forward-looking approach is instrumental in strategic planning and risk management, as it allows businesses to prepare for potential financial challenges and opportunities. The analysis also extends to the examination of internal consistency within the financial records. This involves ensuring that related accounts move in tandem as expected.