Understanding these nuances is crucial for interpreting financial data accurately and avoiding misinformed conclusions about a company’s financial health. Asset accounts represent the resources owned by a company that have economic value and can provide future benefits. These include current assets such as cash, inventory, and accounts receivable, as well as fixed assets like property, plant, and equipment.

( . Expense accounts:

- This is because its normal balance for prepaid expenses is a debit.

- For example, if an asset account which is expected to have a debit balance, shows a credit balance, then this is considered to be an abnormal balance.

- Under the accrual basis of accounting, the Interest Revenues account reports the interest earned by a company during the time period indicated in the heading of the income statement.

- If the customer purchased on credit, a sales allowance will involve a debit to Sales Allowances and a credit to Accounts Receivable.

- Just as you wouldn’t use a hammer to turn a screw, applying debits and credits uniformly across accounts can lead to a financial structure that’s shaky at best.

It refers to the side of the ledger—debit or credit—where the balance of the account is customarily found. For asset and expense accounts, this is typically a debit balance, while liability, equity, and revenue accounts usually have a credit balance. This standardization facilitates the process of recording transactions consistently and aids in the detection of discrepancies. Any particular account contains debit and credit entries.

Liabilities

In accounting, however, debits and credits are neutral terms that simply reflect the dual-sided nature of recording transactions. They do not signify good or bad financial events but are tools to maintain the equilibrium of the accounting equation. Keeping accurate financial records relies on understanding normal balances in financial records.

Revenue

Picture these accounts like fuel gauges measuring the resources burned to keep your business engine running. Notably, these accounts also reflect the impact of sales discount strategies, where reduced revenues due to price concessions are monitored to ensure they align with your financial goals. Each payment made is an expenditure captured, leaving digital footprints across your ledger, shaping your fiscal story one expense at a time. Similarly, there is little reason for a business to pay a liability in excess of what it owes.

Each of the accounts in a trial balance extracted from the bookkeeping ledgers will either show a debit or a credit balance. The normal balance of any account is the balance (debit or credit) which you would expect the account have, and is governed by the accounting equation. Accurate bookkeeping is the backbone of financial health for any business, ensuring that every transaction is properly recorded and accounted for.

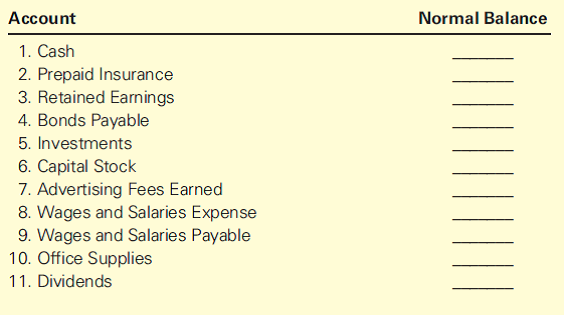

Normal balances of accounts chart”” data-sheets-userformat=””2″:513,”3″:”1″:0,”12″:0″>Normal balances of accounts chart

In article business transaction, we have explained that an event can be journalized as a valid financial transaction only when it explicitly changes the financial position of an entity. In accounting, a change in financial position essentially signifies an increase or decrease in the balances of two or more accounts or financial statement items. The rules of debit and credit determine how a change affected by a financial transaction can be updated in a journal and then applied to accounts in ledger. In business, making sure debits and credits in journal entries match is vital for clear financial reports. This affects how a company makes money and manages its spending, which changes its financial health.

Double-entry bookkeeping is a systematic method for recording financial transactions that requires each entry to have corresponding and opposite effects on at least two different accounts. This method enhances the reliability of financial information, providing a balanced view of a company’s transactions. Debits and credits shape our financial standings in reports like the balance sheet and income statement. This shows the resources used in businesses or personal finance activities. Temporary accounts (or nominal accounts) include all of the revenue accounts, expense accounts, the owner’s drawing account, and the income summary account.

Asset, liability, and most owner/stockholder equity accounts are referred to as permanent accounts (or real accounts). Permanent accounts are not closed at the end of the accounting year; their balances are automatically carried forward normal balance accounting definition to the next accounting year. In accounting, ‘Normal Balance’ doesn’t refer to a state of equilibrium or a mid-point between extremes. Instead, it signifies whether an increase in a particular account is recorded as a debit or a credit.

When your business racks up costs—think salaries, rent, or utilities—it feeds these accounts with debit entries. They naturally inflate on this diet of debits because each expense essentially represents money leaving your corporate wallet. Picture each debit like a puzzle piece, completing the picture of your operating costs. It’s why, in the world of accounting, expenses and debits are best friends, with expense accounts typically flaunting a debit balance as a badge of their vital role in business operations.

Regularly scheduled check-ups can prevent these financial missteps in the future. Aim for best practices like routine reconciliations to keep the pulse of your accounts strong and steady. Asset accounts, like Cash and Inventory, have a debit for their normal balance. On the other hand, liability accounts like Accounts Payable and Notes Payable have a credit normal balance.

In accounting, an account is a specific asset, liability, or equity unit in the ledger that is used to store similar transactions. The following example may be helpful to understand the practical application of rules of debit and credit explained in above discussion. A ledger account (also known as T-account) consists of two sides – a left hand side and a right hand side. The left hand side is commonly referred to as debit side and the right hand side is commonly referred to as credit side.