Conversely, when the company makes a payment on its account payable, it records a debit entry in the Accounts Payable account, decreasing its balance. By understanding and tracking the normal balance of Accounts Payable, businesses can manage their short-term financial obligations efficiently. A normal debit balance for expense accounts is when the total of the debit entries outweigh the credits, reflecting the nature of expenses—where money is spent, not earned. This means your expense accounts should typically have a positive debit balance. To diagnose and correct inaccurate debit balances, start with a thorough health check of your accounts.

Understanding the Basics of Debits and Credits

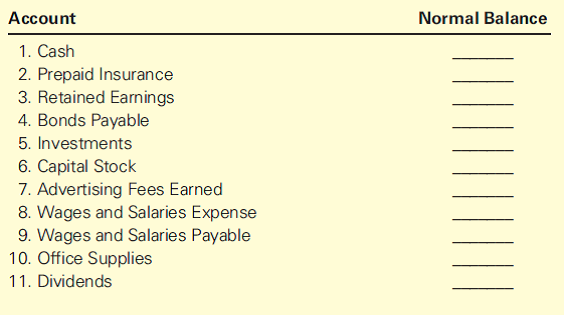

Let’s recap which accounts have a Normal Debit Balance and which accounts have a Normal Credit Balance. Then, I’ll give you a couple of ways to remember which is which. We want to specifically keep track of Dividends in a separate account so we assign it a Normal Debit Balance. Liabilities (on the right of the equation, the credit side) have a Normal Credit Balance.

Normal Debit Balances Made Simple for Expense Accounts

On the other hand, the cash account decreases because of this purchase, so it gets credited. A solid understanding of debits and credits helps keep financial records clear and effective. Accounting transactions normal balance accounting definition change general ledger accounts through these entries. This shapes the financial story of both personal and business finances. Expenses normally have debit balances that are increased with a debit entry.

Role of Normal Balances in Financial Statements

In double-entry bookkeeping, asset accounts typically carry a debit balance. When the value of assets increases, the asset account is debited, and when the value decreases, it is credited. When a financial transaction occurs, it affects at least two accounts. For example, purchase of machinery for cash is a financial transaction that increases machinery and decreases cash because machinery comes in and cash goes out of the business.

- Conversely, when the company receives a payment from a customer for a previously made credit sale, it records a credit entry in the Accounts Receivable account, decreasing its balance.

- For example, Accumulated Depreciation is a contra asset account, because its credit balance is contra to the debit balance for an asset account.

- This means increases are debits and decreases are credits.

- Sales are reported in the accounting period in which title to the merchandise was transferred from the seller to the buyer.

- The meaning of normal balance in accounting is something one would learn at the very beginning of their bookkeeping and accounting studies.

Normal Balances of Accounts Chart

Since expenses are usually increasing, think “debit” when expenses are incurred. Accounts Payable is a liability account, and thus its normal balance is a credit. When a company purchases goods or services on credit, it records a credit entry in the Accounts Payable account, increasing its balance.

Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. A credit to a liability account increases its credit balance. Knowing the normal balance of each account is key to being able to records the transactions correctly and maintain the balance in the accounting equation. This information is also valuable when it comes to spotting any inconsistencies.

For example, Accumulated Depreciation is a contra asset account, because its credit balance is contra to the debit balance for an asset account. This is an owner’s equity account and as such you would expect a credit balance. Other examples include (1) the allowance for doubtful accounts, (2) discount on bonds payable, (3) sales returns and allowances, and (4) sales discounts. The contra accounts cause a reduction in the amounts reported. For example net sales is gross sales minus the sales returns, the sales allowances, and the sales discounts.

Adherence to these norms is not merely a matter of convention but a functional necessity for the clarity and accuracy of financial data. As we wrap up our chat on accounting, it’s key to remember that knowing about normal balances is crucial. Liabilities, on the other hand, rise with credits and fall with debits. It impacts a company’s operational costs, profitability, and bottom line. Ideally, all the above-mentioned account types should have a normal balance as stated.

Remember, this methodical approach keeps your financial story clear, offering a frame-by-frame account of where your resources are flowing. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.