Nonetheless, it may happen that a debit account has a credit balance as well. As a rule, one of the major indicators that something goes wrong is the fact that an account has an abnormal balance, which is the opposite of the normal one. In this case, there might be an error or other issue that requires an urgent investigation.Keep in mind that if an account is usually a debit one, any debit entry increases the balance. If an account is usually credit, any credit entry increases the balance. Therefore, it’s so important to make only the right entries, as they influence the balance directly. If they’re filled out incorrectly, the company will eventually suffer inevitable losses.

What are the Normal Balances of each type of account?

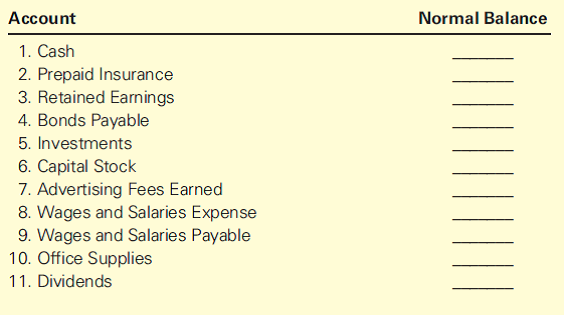

It is possible for an account expected to have a normal balance as a debit to actually have a credit balance, and vice versa, but these situations should be in the minority. The normal account balance for many accounts are noted in the following exhibit. Knowing and applying these rules well ensures operating expenses line up with revenues.

What is Cash Basis in Accounting? The Cash Basis Explained

Even though it may happen that an account has a certain balance type, whereas it should have another one, it’s usually a rare thing. In order to see what balance each account type should have, we present you with the table below. He has $30,000 sitting in inventory and buys another 5 computers worth $10,000.

Permanent and Temporary Accounts

They show changes in accounts within the bookkeeping system. Debits increase asset and expense accounts but decrease liabilities, equity, and revenue. Following best practices in accounting is crucial for accurate financial records.

( . Expense accounts:

Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry. In a T-account, their balances will be on the right side. In accounting, debits and credits are the fundamental building blocks in a double-entry accounting system. Depending on the account type, an increase or decrease can either be a debit or a credit. Understanding the difference between credit and debit is needed.

Generally speaking, the balances in temporary accounts increase throughout the accounting year. At the end of the accounting year the balances will be transferred to the owner’s capital account or to a corporation’s retained earnings account. This means when a company makes a sale on credit, it records a debit entry in the Accounts Receivable account, increasing its balance. Conversely, when the company receives a payment from a customer for a previously made credit sale, it records a credit entry in the Accounts Receivable account, decreasing its balance. It’s essentially what’s left over when you subtract liabilities from assets.

An accurate tally of expenses is crucial for determining the net income of a company, as they are subtracted from revenues in the income statement. Monitoring these accounts helps in controlling costs and improving the company’s overall financial efficiency. In budgeting and forecasting, normal balances serve as a guide for predicting future financial transactions and their impact on a company’s financial statements. When creating a budget, accountants project the expected debits and credits for each account, based on historical data and anticipated business activities. This projection helps in setting financial targets and establishing benchmarks for performance evaluation. Revenue accounts track the income a company earns from its normal business operations, such as sales of goods or services.

- Expense accounts are used to record the consumption of assets or services that are necessary to generate revenue.

- It keeps the company’s financials accurate and makes sure the balance sheet is correct.

- This doesn’t just ensure your books are not just a historical record, but also a beacon for forward-thinking decisions.

- Conversely, any adjustments or returns that reduce revenue are recorded as debits.

Knowing the normal balances of accounts is pivotal for recording transactions correctly. It aids in maintaining accurate financial records and statements that mirror the true financial position normal balance accounting definition of your business. Misunderstanding normal balances could lead to errors in your accounting records, which could misrepresent your business’s financial health and misinform decision-making.

When transactions are recorded, they must align with the expected normal balance of the respective account. For example, when a business purchases equipment, the equipment asset account is debited, reflecting an increase in assets. Conversely, when a business takes out a loan, the loan liability account is credited, signifying an increase in liabilities.

No, revenue accounts typically have a normal credit balance because they reflect income earned by the business, not money spent. Seeing a debit balance here would be unusual and possibly indicative of a reversal or adjustment. Dive into T-accounts and you’ll find a method of accounting visualization that transforms abstract transactions into tangible illustrations. Like training wheels for accountants, T-accounts provide a safe and clear pathway for learners to navigate the twists and turns of financial record-keeping. They break down the complexity of a ledger into bite-sized visuals, making the relationship between debits and credits crystal clear. T-accounts are the scaffolding upon which budding accountants can construct a robust understanding of bookkeeping principles.